Shipping Markets Outlook for H2 2025 – Navigating Geopolitical Tensions, Trade Policies, and Sector Dynamics

This article is summarised from the podcast of Seatrade Maritime News on July, 2025 hosted by Marcus Hand

As the global shipping industry enters 2nd half of 2025, a complex web of geopolitical tensions, trade policies, and economic shifts continues to shape market dynamics. The sector faces multiple challenges and opportunities, influenced heavily by policy decisions and regional economic performance. Here’s an in-depth look at some of the critical factors affecting container shipping, dry bulk, tanker markets, and shipbuilding.

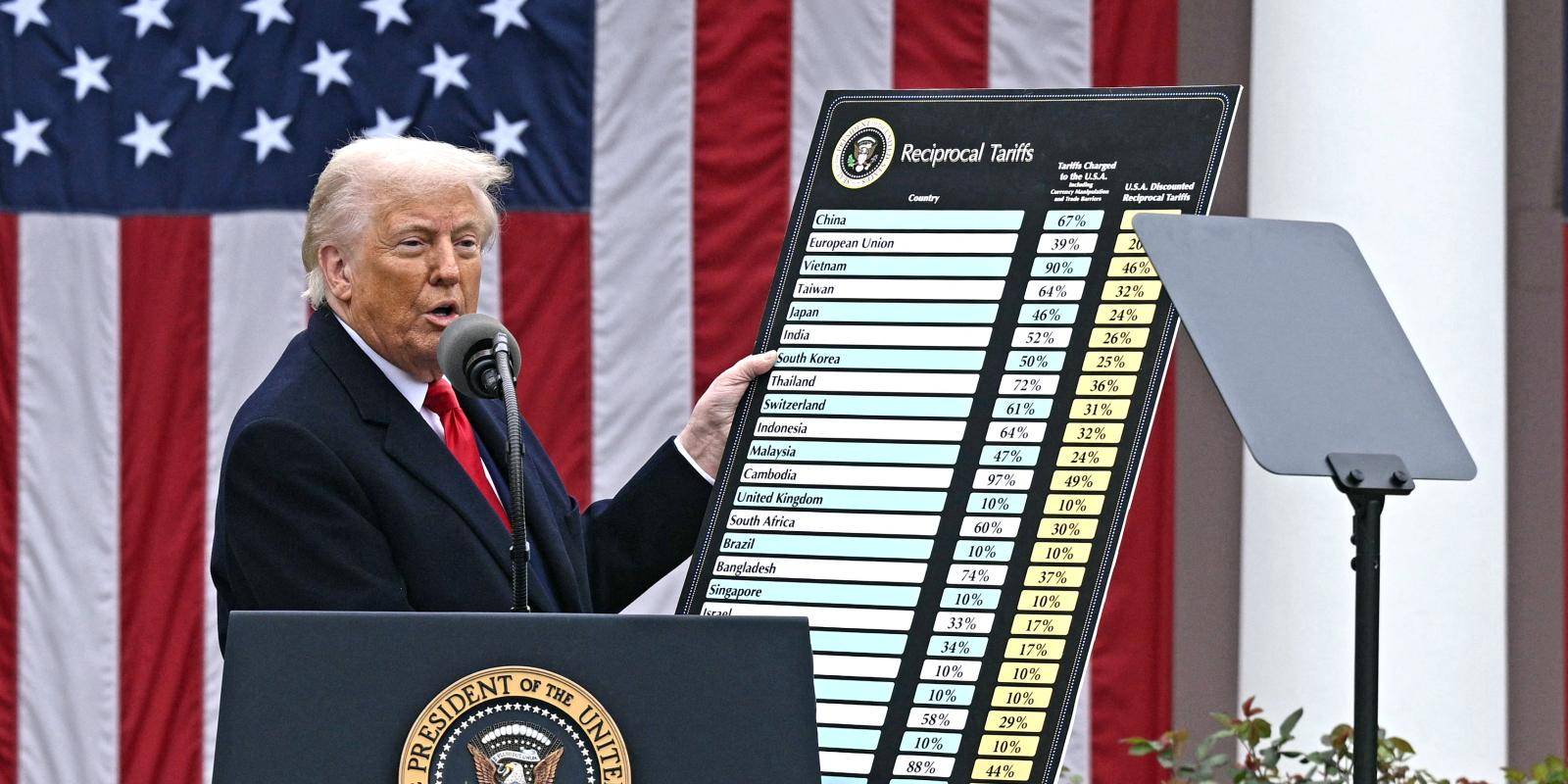

The Impact of U.S. President Trump’s On/Off Tariffs on the Container Shipping Market

Trade tariffs have long been a significant source of uncertainty for the container shipping industry. The fluctuating stance of U.S. policies, especially under former President Donald Trump’s administration, has created a rollercoaster effect on global trade flows. During his tenure, tariffs on Chinese goods and retaliatory measures by China disrupted supply chains, causing irregular shipping patterns and impacting freight rates.

In 2025, although the Biden administration has maintained some tariffs, the threat of new or reinstated tariffs remains, especially as geopolitical tensions with China persist. The possibility of tariffs being reintroduced or increased—potentially by 10-40%—continues to cast a shadow over the industry. Carriers are cautious, adjusting routes and inventory strategies to mitigate risks.

The uncertainty has led to volatility in freight rates, with some periods of congestion and high demand, particularly when tariffs are announced or threatened, and slowdowns when tariffs are temporarily eased or negotiations appear promising. This on/off tariff cycle complicates long-term planning and investment decisions for shipping lines, port authorities, and logistics companies.

Is China Still the Engine of Growth for the Sector Amid Weak Dry Bulk Demand?

China has historically been the engine of growth for global shipping, especially in dry bulk and container sectors. However, in 2025, signs of weakening Chinese demand are raising questions about whether this trend still holds.

Chinese economic growth has slowed, amid ongoing property sector struggles and regulatory crackdowns on certain industries. The country’s domestic demand for commodities like iron ore, coal, and grain has shown signs of stagnation or decline, impacting dry bulk shipping volumes.

Despite these challenges, China remains a key player, especially in manufacturing and export-driven trade. The nation continues to be a significant contributor to global container throughput, with its vast hinterland and extensive manufacturing base. However, the growth rate has decelerated compared to previous years, and the sector is now more reliant on regional trade within Asia than on global growth.

In the dry bulk market, weak demand from China has led to lower freight rates and oversupply issues, impacting shipowners’ profitability. While China remains an essential driver of global trade, its role as the primary growth engine is now more subdued, prompting the industry to diversify and seek new markets.

OPEC+ Supply Increases and Their Impact on the Tanker Market

The tanker market, closely tied to oil demand, has experienced fluctuations driven by OPEC+ decisions. In 2025, OPEC+ countries have announced increased oil production, aiming to stabilize or boost revenues amid uncertain global economic conditions.

This supply increase has a mixed impact on tanker demand. On one hand, higher supply can lead to lower oil prices, reducing the incentive for stockpiling and affecting crude oil transportation volumes negatively. On the other hand, increased production can stimulate economic activity and energy consumption in certain regions, potentially boosting short-term tanker demand.

Overall, the market is experiencing a balancing act. The increased supply has cooled some of the recent price rallies, leading to softer freight rates, especially for VLCCs and Suezmax vessels. However, geopolitical tensions and the ongoing need for strategic reserves in some countries continue to support demand for tankers, preventing a significant downturn.

How Much Do Korean and Japanese Shipbuilders Stand to Gain from USTR Fees on Chinese Built and Owned Ships Calling U.S. Ports?

U.S.-China trade tensions have prompted regulatory measures, including tariffs and fees, targeting Chinese-built and owned ships calling at U.S. ports. The USTR (United States Trade Representative) has implemented fees aimed at discouraging the use of Chinese vessels, which has significant implications for the shipbuilding industries in Korea and Japan.

Korean and Japanese shipbuilders, known for their high-quality and technologically advanced vessels, stand to benefit from these policies. As U.S. port authorities seek alternatives to Chinese ships, they increasingly turn to ships built by Korean and Japanese shipyards. This shift can boost orders for new vessels, especially LNG carriers, container ships, and tankers, which are in high demand.

Moreover, these countries could see increased retrofit and repair contracts as U.S. operators upgrade existing fleets to meet regulatory standards or replace Chinese-built ships. The tariffs and fees effectively create a more favorable environment for Korean and Japanese shipbuilders, enabling them to capture a larger share of the U.S. market and strengthen their global position.

Conclusion

The shipping industry in 2025 is navigating a landscape marked by geopolitical tensions, shifting trade policies, and regional economic uncertainties. The impact of fluctuating U.S. tariffs continues to create volatility for container carriers, while weak Chinese demand challenges the traditional growth engine for dry bulk trade. Meanwhile, increased OPEC+ oil production influences tanker market dynamics, and regulatory measures against Chinese ships are opening new opportunities for Korean and Japanese shipbuilders.

As the industry adapts to these challenges, resilience and strategic diversification will be key drivers for growth in this complex environment. Stakeholders who can anticipate policy shifts and regional economic trends will be better positioned to capitalize on emerging opportunities.

Sources: Marcus Hand from Seatrade Maritime News, 2025